SSA weighs axing payments to 170,000 beneficiaries

A proposal to ban payments to people without Social Security numbers is circulating at the Social Security Administration, according to two employees. If implemented, the move could affect thousands of beneficiaries receiving retirement, disability and low-income benefits from the agency.

There are several scenarios where people without SSNs accept benefits as the “representative payee” on behalf of eligible beneficiaries—including most disabled children, as well as elderly or disabled adults, said Kathleen Romig, the director of Social Security and disability policy at the Center on Budget and Policy Priorities.

An SSA memo obtained by Government Executive notes that the agency currently can, at times, make someone a representative payee even if they don’t have an SSN. The payee, Romig noted, is not required to be eligible for benefits themselves.

The new policy proposal would bar any payments to payees without SSNs, of which there are currently more than 170,000, according to the document. The Social Security Administration did not respond to a request for comment Thursday.

One large group that could be affected by the proposed change would be children receiving Supplemental Security Income or disability benefits whose parents don’t have an SSN. Others impacted could include widows and other survivors of dead Americans living overseas.

The proposal may be wrapped up in the administration’s immigration policies, said several SSA employees.

“The only time we pay someone who is here illegally is when they are a payee,” one explained. “So by barring people without SSNs from applying to be payee, they would be able to say they stopped paying illegal immigrants Social Security. But it will create a crisis. We usually are paying them because their kid is severely disabled and still a minor. If they aren’t the right person to manage funds, who is?”

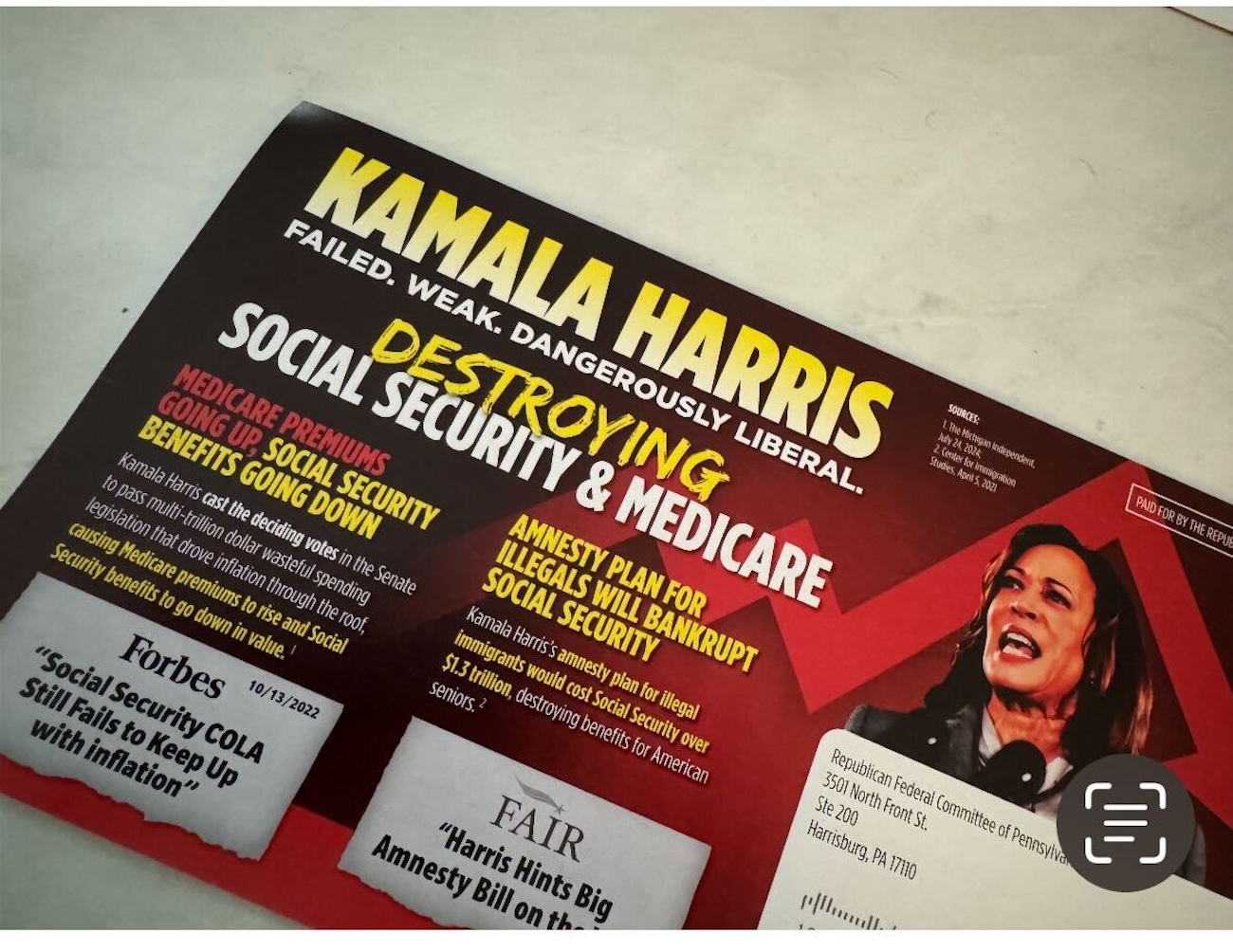

Campaign Misinformation

Former Commissioner Martin O’Malley, who ran the agency for a year at the end of the Biden administration, connected the policy change to misinformation disseminated by President Trump during last year’s campaign claiming that Democrats were allowing undocumented immigrants to receive benefits. He called those responsible for denying the disabled children of immigrants their Social Security benefits “cruel hearted jerks.”

“They spent a lot of money on direct mail across all the swing states telling people that [then-presidential candidate Kamala Harris] wants to keep allowing illegal immigrants to bankrupt Social Security,” he told Government Executive. “This must be the next big lie to discredit the program and degrade public trust. We got so many calls because of the campaign mailer that we had to post a disclaimer message on the top of our webpage, like we do for fraud alerts. They were all asking us why we were giving money to illegal immigrants.”

The agency needs to confirm that it has the authority to make this change, the memo notes. If SSA moves forward, it would need to “work” the thousands of cases, contacting the payees to submit a SSN or change the payee altogether to someone that has a number.

That task could be arduous, as finding payees is already so difficult that at times the agency turns to institutional payees like child welfare agencies, said Romig. SSA staff also have to assess the suitability of payees.

“Say you’re a kid and you don’t have a payee for a while — they stop paying the benefit until they sort it out,” she said of the potential for interruptions to benefits.

Moving forward, the potential change may make it harder to find payees for some beneficiaries at all, because the best person simply doesn’t have a SSN, according to the internal document. Currently, parents of minors are always the preference because of the potential for abuse, including a payee stealing the benefits, said one SSA employee.

“Prospectively, it will likely be more challenging for staff to identify suitable representative payees for certain beneficiaries because the most preferred representative payee candidate (e.g. parent, spouse) may not have an SSN,” the document states. “There may be a higher risk of fraud or misuse if we select a friend, other relative or organization as representative payee instead of a parent or spouse.”

Another potentially affected group would be foreign payees who’ve come to the United States legally and worked long enough to become entitled to benefits. If they require a payee, that person may not have a SSN or have ever even been to the U.S., another employee told Government Executive.

Disruption and Improvisation

The proposal comes less than a week after the agency announced that it would once again begin seeking to recoup 100% of a beneficiary’s monthly check in instances where they had previously been overpaid. O’Malley ended that practice last year following bipartisan congressional outcry.

“We have the significant responsibility to be good stewards of the trust funds for the American people,” said Acting Commissioner Leland Dudek, who was put in charge of the agency after its previous acting leadership left after clashing with DOGE. “It is our duty to revise the overpayment repayment policy back to full withholding, as it was during the Obama administration and first Trump administration, to properly safeguard taxpayer funds.”

The agency also announced Wednesday that it will no longer allow people to make changes to their direct deposit information over the phone, citing fraud. That plan itself marked the walking back of a quickly derided proposal to cease telephone service altogether.

At a panel discussion hosted by the National Academy of Social Insurance on Thursday, former SSA commissioners of both parties railed against the actions taken by Dudek and DOGE operatives.

“There are a lot of constructive things you could do [to improve efficiency at SSA], and if you wanted to reduce the size of the agency a little bit, you could do that,” said former Commissioner Michael Astrue, who served under President George W. Bush. “But what’s happening now is just wrong . . . There’s this west coast, high tech, video game-playing thing about so-called ‘disruption.’ And in some ways I admire Elon Musk as a disrupter, if you look at cars and rockets and I give him all the credit for that. But what I’m concerned about now is another form of disruption, where you come into some place established, level it, and then improvise your way out . . . I think it’s very destructive.”

O’Malley said the plan to downsize the Social Security workforce by 7,000 employees, including through Voluntary Early Retirement Authority, is particularly galling because of the agency’s funding coming directly from Americans’ payroll taxes.

“The biggest threat to the agency right now is paying people to leave the agency,” he said. “I recently did a town hall, where citizens in Florida asked me ‘Where are they getting the money from?’ And I said, ‘They’re getting it from you, the beneficiaries who paid into Social Security. They’re not only denying you the customer service you need to access your benefits, they are taking the money you put into the system to pay people not to work and to leave and to get rid of the most experienced people.”

Astrue, discussing the increased risk of a cybersecurity failure in light of DOGE operatives’ access to sensitive SSA databases, urged the Senate Finance Committee to move swiftly on the nomination of Frank Bisignano to lead the agency, noting “he can’t possibly be any worse” than Dudek, who was being investigated for improperly sharing information with DOGE when he was put in his current role.

“I don’t attribute being a traitor to these people—I am attributing to them being idiots and not knowing what they’re doing,” he said. “A download of data that they shouldn’t have may well make it accessible to bad actors in a way that can’t be fixed. It’s time for this guy to go. He doesn’t have the character or the professional experience. He’s behaved and performed extremely poorly, and he should resign.”